any other information relating to the nominating person that would be required to be disclosed in a proxy statement filed with the SEC.

With respect to proposed director nominees, the stockholder’s notice must include all information required to be disclosed in a proxy statement in connection with a contested election of directors or otherwise required pursuant to Regulation 14A under the Exchange Act (including such person’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected).

For matters other than the election of directors, the stockholder’s notice must also include a brief description of the business desired to be brought before the meeting, the reasons for conducting such business at the meeting and any material interest in such business of the stockholder(s) proposing the business.

The stockholder’s notice must be updated and supplemented, if necessary, so that the information required to be provided in the notice is true and correct as of the record date for the meeting and as of the date that is ten business days prior to the meeting.

The Board of Directors, a designated committee thereof or the chairmanchairperson of the meeting will determine if the procedures in our Bylaws have been followed, and if not, declare that the proposal or nomination be disregarded. The nominee must be willing to provide any other information reasonably requested by the Nominating and Corporate Governance Committee in connection with its evaluation of the nominee’s independence. There have been no material changes to the process by which stockholders may recommend nominees to our Board of Directors.

Stockholder Communications with the Board of Directors

Stockholders may send correspondence to the Board of Directors c/o the ChairmanChairperson of the Board at our principal executive offices at the address set forth above. The Company will forward all correspondence addressed to the Board or any individual Board member. Stockholders may also communicate online with our Board of Directors as a group by accessing our website (www.MyoKardia.com) and selecting the “Investors & Media”“Investors” tab.

Director Attendance at Annual Meetings

Directors are encouraged to attend the annual meeting of stockholders. Five of our directors attended the 2019 Annual Meeting.Meeting of Stockholders.

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee is, or has at any time during the past fiscal year been, an officer or employee of the Company or had any relationship requiring disclosure under Item 404 of Regulation S-K. None of the members of the Compensation Committee has formerly been an officer of the Company. None of our executive officers serve, or in the past fiscal year, have served as a member of the Board of Directors or Compensation Committee of any other entity that has one or more executive officers serving as a member of our Board of Directors or Compensation Committee.

Director Compensation

In October 2015, our Board of Directors adopted a non-employee director compensation policy, which became effective upon the completion of our initial public offering in November 2015, that is designed to provide a total compensation package that enables us to attract and retain, on a long-term basis, high-caliber non-employee directors. In March 2016, the policy was amended to provide for the payment of annual cash retainers for service on the Science and Technology Committee. Under thisEffective January 2018, the policy was amended to provide for an annual cash retainer for service as a lead independent director or non-executive chairperson. In January 2019, the policy was amended as to the cash and equity components of the compensation.

In 2019, the policy provided that all non-employee directors are paidwould receive cash compensation for service on the Board of Directors and committees of the Board of Directors as set forth below, prorated based on days of service during a calendar year.

| | | | Year Ending December 31, 2019 | |

Board of Directors | | Annual

Retainer | | | Annual Retainer | |

All non-employee members | | $ | 35,000 | | |

Chairperson or lead independent director | | | $ | 70,000 | |

All other non-employee members | | | $ | 40,000 | |

| | | Additional Annual Retainer | |

Audit Committee: | | | | | | |

Chairperson | | $ | 15,000 | | | $ | 20,000 | |

Non-Chairperson members | | $ | 7,500 | | | $ | 10,000 | |

| Compensation Committee: | | | | | | |

Chairperson | | $ | 10,000 | | | $ | 15,000 | |

Non-Chairperson members | | $ | 5,000 | | | $ | 7,500 | |

| Nominating and Corporate Governance Committee: | | | | | | |

Chairperson | | $ | 7,500 | | | $ | 10,000 | |

Non-Chairperson members | | $ | 3,500 | | | $ | 5,000 | |

| Science and Technology Committee: | | | | | | |

Chairperson | | $ | 10,000 | | | $ | 15,000 | |

Non-Chairperson members | | $ | 5,000 | | | $ | 7,500 | |

In addition, under the policy, as amended, each new non-employee director who is initially appointed or elected to our Board of Directors will receive (i) an option grant to purchase up to 22,00013,200 shares of our common stock, which will vest in equal monthly installments during the 48 months following the grant date, subject to the director’s continued service on our Board of Directors.Directors through each vesting date and (ii) a grant of restricted stock units (“RSUs”) for 4,500 shares of our common stock, which will vest in equal annual installments during the four years following the grant date, subject to the director’s continued service on our Board of Directors through each vesting date. Thereafter, on the date of each annual meeting of stockholders, each continuing non-employee director will be eligible to receive an annual (i) option grant to purchase up to 11,0006,600 shares of our common stock, which will vest in equal monthly installments during the 12 months following the date of grant, subject to the director’s continued service on our Board of Directors.Directors through each vesting date and (ii) grant of RSUs for 2,300 shares of our common stock, which will vest in a single installment on the first anniversary of the date of grant, subject to the director’s continued service on our Board of Directors through such vesting date. All stock options and RSUs granted to our non-employee directors pursuant to this policy, as amended, are subject to full acceleration of vesting upon the consummation of a sale event.Sale Event (as defined in the 2015 Plan). All of the foregoing options will be granted with ana per share exercise price equal to the fair market value of a share of our common stock on the date of grant and will be exercisable (to the extent vested) for up to one year following the cessation of the director’s service on our Board of Directors, so long as the director was not removed for cause. Our non-employee directors may also be granted such additional stock optionsequity awards in such amounts and on such dates as our Board of Directors may recommend.

In April 2020, the policy was further amended to increase the amounts for the annual retainer for board membership from $70,000 to $77,500 for the chairperson or lead independent director and from $30,000 to $45,000 for all other non-employee members. In addition, under the policy, as amended, each new non-employee director who is initially appointed or elected to our Board of Directors will receive (i) an option grant to purchase 7,400 shares of our common stock, which will vest in equal monthly installments during the 48 months following the grant date, subject to the director’s continued service on our Board of Directors through each vesting date and (ii) a grant of RSUs for 4,800 shares of our common stock, which will vest in equal annual installments during the four years following the grant date, subject to the director’s continued service on our Board of Directors through each vesting date. Thereafter, on the date of each annual meeting of stockholders, each continuing non-employee director will be eligible to receive an annual (i) option grant to purchase 3,700 shares of our common stock, which will vest in equal monthly installments during the 12 months following the date of grant, subject to the director’s continued service on our Board of Directors through each vesting date and (ii) grant of RSUs for 2,400 shares of our common stock, which will vest in a single installment on the first anniversary of the date of grant, subject to the director’s continued service on our Board of Directors through such vesting date. For any director who joins our Board of Directors

within 12 months preceding the date of our annual grants, such annual grants shall be prorated accordingly. All options and RSUs granted to our non-employee directors pursuant to this policy, as amended, are subject to full acceleration of vesting upon the consummation of a Sale Event (as defined in the 2015 Plan). All of the foregoing options will be granted with a per share exercise price equal to the fair market value of a share of our common stock on the date of grant and will be exercisable (to the extent vested) for up to one year following the cessation of the director’s service on our Board of Directors, so long as the director was not removed for cause. Our non-employee directors may also be granted such additional equity awards in such amounts and on such dates as our Board of Directors may recommend.

We have agreed to reimburse all reasonable out-of-pocket expenses incurred by our non-employee directors in attendingto attend meetings of the Board of Directors and committee meetings.

committees thereof.Director Compensation Table—20152019

The following table sets forth information with respect to the compensation earned by or paid to our non-employee directors during the fiscal year ended December 31, 2015.2019. Mr. Gianakakos doeswas an employee during such year and did not receive compensation for his service on the Board of Directors and theDirectors. The compensation paid to Mr. Gianakakos during the fiscal year ended December 31, 2019 as an employee of the Company is set forth under the heading “Compensation“Compensation of Named Executive Officers—2019 Summary Compensation Table”Table” below. Mary B. Cranston and Sunil Agarwal each joined our Board of Directors in 2016, and accordingly, did not receive any compensation from us during the year ended December 31, 2015.

| | | | | | | | | | | | | | | | |

Name | | Fees Earned or

Paid in Cash

($) | | | Option

Awards

($)(1) | | | All Other

Compensation

($) | | | Total

($) | |

Kevin Starr (2) | | $ | 8,791 | | | $ | — | | | $ | — | | | $ | 8,791 | |

Charles Homcy, M.D. (3) | | $ | 8,352 | | | $ | — | | | $ | 38,539 | | | $ | 46,891 | |

Mark Perry (4) | | $ | 36,799 | | | $ | 179,185 | | | $ | — | | | $ | 215,985 | |

Eric Topol, M.D. (5) | | $ | 7,648 | | | $ | 406,421 | | | $ | — | | | $ | 414,069 | |

Sunil Agarwal, M.D. (6) | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

Mary Cranston (7) | | | — | | | | — | | | | — | | | | — | |

Name | | Fees Earned or Paid in Cash ($) | | Option Awards ($)(1) | | Stock Awards ($)(1) | | Total ($) | |

Sunil Agarwal, M.D. (2) | | | 62,500 | | | 195,315 | | 109,871 | | | 367,686 | |

Mary Cranston (3) | | | 70,000 | | | 195,315 | | 109,871 | | | 375,186 | |

David Meeker, M.D. (4) | | | 47,500 | | | 195,315 | | 109,871 | | | 352,686 | |

Mark Perry (5) | | | 95,000 | | | 195,315 | | 109,871 | | | 400,186 | |

Kimberly Popovits (6) | | | 45,000 | | | 195,315 | | 109,871 | | | 350,186 | |

Wendy Yarno (7) | | | 57,500 | | | 195,315 | | 109,871 | | | 362,686 | |

(1) | In accordance with SEC rules, this column reflects the aggregate grant date fair value of the option awards and RSUs granted during 2015the fiscal year ended December 31, 2019 computed in accordance with Financial Accounting Standard Board Accounting Standards Codification Topic 718 for stock-based compensation transactions (“FASB ASC Topic 718”). Such aggregate grant date fair values do not take into account any estimated forfeitures related to service-vesting conditions. Assumptions used in the calculation of these amounts are included in Note 89 to our consolidated financial statements included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2015.2019. These amounts do not reflect the actual economic value that may be realized by the directors upon the vesting of the stock options, the exercise of the stock options or the sale of the common stock underlying such stock options. |

(2) | Mr. Starr did not hold any stock options or other equity compensation awards asvesting and settlement of December 31, 2015.the RSUs. |

(3)(2) | Dr. Homcy did not hold any stock options or other equity compensation awards as of December 31, 2015. Amount disclosed under “All Other Compensation” for Dr. Homcy represents principal and interest forgiven in September 2015 under a loan from the Company to Dr. Homcy made in March 2013 in connection with Dr. Homcy’s purchase of shares of restricted common stock. |

(4) | Mr. PerryAgarwal held stock options to purchase an aggregate of 21,80061,600 shares of our common stock and 2,300 RSUs as of December 31, 2015.2019. |

(5)(3) | Dr. Topol was appointed to the Board of Directors in October 2015 andMs. Cranston held stock options to purchase an aggregate of 43,53761,600 shares of our common stock and 2,300 RSUs as of December 31, 2015.2019. |

(6)(4) | Dr. Agarwal was appointedMeeker held options to the Boardpurchase an aggregate of Directors in March 2016.50,600 shares of our common stock and 2,300 RSUs as of December 31, 2019. |

(7)(5) | Ms. Cranston was appointedMr. Perry held options to the Boardpurchase an aggregate of Directors in April 2016.61,400 shares of our common stock and 2,300 RSUs as of December 31, 2019. |

(6) | Ms. Popovits held options to purchase an aggregate of 50,600 shares of our common stock and 2,300 RSUs as of December 31, 2019. |

(7) | Ms. Yarno held options to purchase an aggregate of 50,600 shares of our common stock and 2,300 RSUs as of December 31, 2019. |

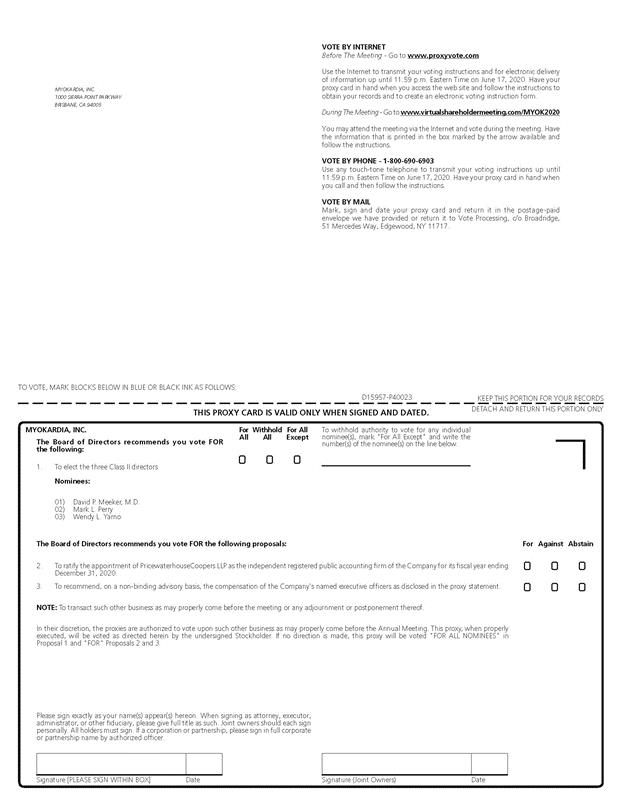

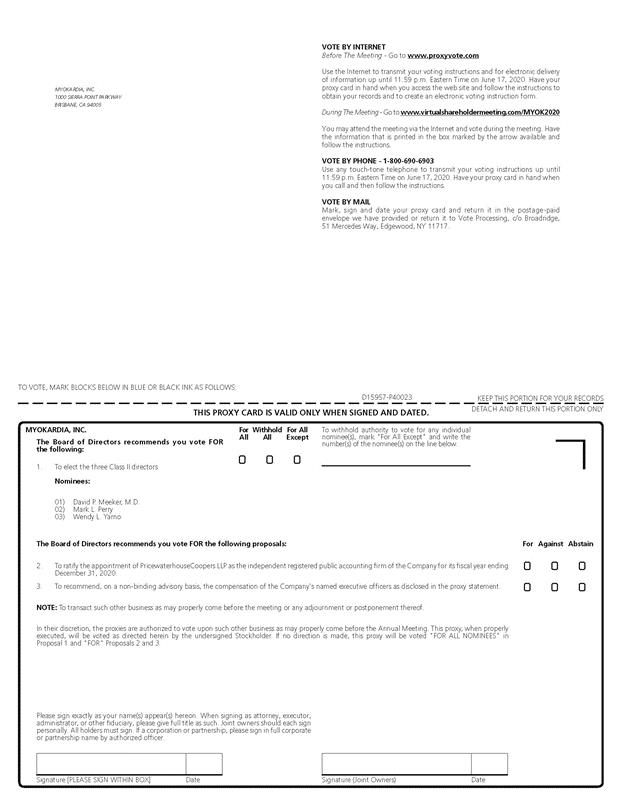

Required Vote

The two (2)three (3) nominees receiving the highest number of affirmative votes of all the votes properly cast shall be elected as Class III directors to serve until the 20192023 Annual Meeting of Stockholders or until their successors have been duly elected and qualified.

Recommendation of the Board of Directors

The Board of Directors recommends that the stockholders vote FOR the election of the two (2)three (3) Class III director nominees listed above.

PROPOSALPROPOSAL 2

RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has appointed PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for 2016.2020. Representatives of PricewaterhouseCoopers LLP will attend the Annual Meeting and will have the opportunity to make a statement if they desire to do so. They will also be available to respond to appropriate questions.

The Company’s organizational documents do not require that the stockholders ratify the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm, and stockholder ratification is not binding on the Company, the Board or the Audit Committee. The Company requests such ratification, however, as a matter of good corporate practice. The ratification of the selection of PricewaterhouseCoopers LLP requires the affirmative vote of a majority of the votes cast on the proposal at the Annual Meeting. Our Board, including our Audit Committee, values the opinions of our stockholders and, to the extent there is any significant vote against the ratification of the selection of PricewaterhouseCoopers LLP as disclosed in this Proxy Statement, we will consider our stockholders’ concerns and evaluate what actions may be appropriate to address those concerns, although the Audit Committee, in its discretion, may still retain PricewaterhouseCoopers LLP.

The following table shows information about fees billed to the Company by PricewaterhouseCoopers LLP for the fiscal years ended December 31, 20152019 and 2014:2018:

| Fees billed by PricewaterhouseCoopers LLP | | 2015 | | | 2014 | | | 2019 | | | 2018 | |

Audit Fees (1) | | $ | 1,311,249 | | | $ | 572,500 | | | $ | 1,641,500 | | | $ | 2,051,000 | |

Audit Related Fees | | | — | | | | — | | | | — | | | | — | |

Tax Fees | | | — | | | | — | | | | — | | | | — | |

All Other Fees | | | — | | | | — | | |

| | | | | | | |

All Other Fees (2) | | | | 2,700 | | | | — | |

Total | | $ | 1,311,249 | | | $ | 572,500 | | | $ | 1,644,200 | | | $ | 2,051,000 | |

(1) | Includes fees associated with the annual audit of our financial statements, the reviews of our interim financial statements and the issuance of consentconsents and comfort letters in connection with registration statements, including,statements. |

(2) | Fees associated with respectthe annual subscription to the year ended December 31, 2015, the filing of our registration statement on Form S-1 for our initial public offering. Included in the 2015 audit fees is $583,250 of fees billed in connection with our initial public offering.PwC’s accounting research and disclosure checklist tools. |

Audit Committee Pre-Approval Policies

The Audit Committee is directly responsible for the appointment, retention and termination, and for determining the compensation, of the Company’s independent registered public accounting firm. The Audit Committee shall pre-approve all auditing services and the terms thereof and non-audit services (other than non-audit services prohibited under Section 10A(g) of the Exchange Act or the applicable rules of the SEC or the Public Company Accounting Oversight Board), except that pre-approval is not required for the provision of non-audit services if the “de minimus”minimis” provisions of Section 10A(i)(1)(B) of the Exchange Act are satisfied. The Audit Committee may delegate to the chairperson of the Audit Committee the authority to grant pre-approvals for audit and non-audit services, provided such approvals are presented to the Audit Committee at its next scheduled meeting. All services provided by PricewaterhouseCoopers LLP during fiscal year 2015 following our initial public offeringyears 2019 and 2018 were pre-approved by the Audit Committee in accordance with the pre-approval policy described above, and all audit fees during fiscal year 2014 were approved by the Board of Directors.above.

Required Vote

The ratification of the selection of PricewaterhouseCoopers LLP requires the affirmative vote of a majority of the votes cast on the proposal at the Annual Meeting (meaning the number of shares voted “for” the proposal

must exceed the number of shares voted “against” the proposal). Abstentions are not considered votes cast for the foregoing purpose and will have no effect on the vote for this proposal.

Recommendation of the Board of Directors

The Board of Directors recommends that the stockholders vote FOR the ratification of the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm of the Company for its fiscal year ending December 31, 2016.2020.

PROPOSAL 3

PROPOSAL 3NON-BINDING ADVISORY VOTE TO APPROVE THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

RATIFICATION OF 2015 STOCK OPTION AND INCENTIVE PLANSection 14A of the Exchange Act requires that we provide our stockholders with the opportunity to vote to approve, on a non-binding, advisory basis, not less frequently than once every three years, the compensation of our named executive officers as disclosed in this proxy statement in accordance with the compensation disclosure rules of the SEC. At our 2019 Annual Meeting of Stockholders, our stockholders approved one year as the frequency for holding non-binding advisory votes to approve the compensation of our named executive officers.

Our Board of Directors believes that stock options and other stock-based incentive awardscompensation programs are an important part of compensationdesigned to effectively align our employees and consultants which allow the Company to stay competitive in the market for experienced employees while aligningexecutives' interests with the interests of employeesour stockholders by focusing on long-term equity incentives that correlate with stockholders. As we advancethe growth of sustainable long-term value for our lead product candidate, MYK-461 through completionstockholders.

Stockholders are urged to read the section titled “Compensation Discussion and Analysis” in this proxy statement, which discusses how our executive compensation policies and practices implement our compensation philosophy and contains tabular information and narrative discussion about the compensation of Phase 2 clinical trials, and advance our ongoing preclinical discovery and research programs, we anticipate the need to hire additional personnel while maintaining our existing personnel in order to support these activities. As such, the Board of Directors believes that we need to maintain a competitive position in attracting, retaining and motivating employees and consultants. In order to remain competitive, a major component of employee compensation in the Bay Area market is the award of stock options, and it is incumbent upon the Board of Directors and the Company to ensure that the award of stock options under our 2015 Stock Option and Incentive Plan (the “2015 Plan”) is tax efficient under IRS regulations.

Prior to our initial public offering, thenamed executive officers. Our Board of Directors and our stockholders approved the 2015 Plan. Under pertinent IRS regulations, grants made to “Covered Employees” (as definedCompensation Committee believe that these policies and practices are effective in Section 162(m) of the Internal Revenue Code of 1986, as amended, or the Code) under the 2015 Plan prior to the earlier of (i) the material modification of the 2015 Plan or (ii)implementing our 2019 annual meeting of stockholders (the “Reliance Period”) are not subject to the cap on the Company’s tax deduction imposed by Section 162(m) of the Code with respect to compensation philosophy and in excess of $1,000,000 per Covered Employee in any year. The Board of Directors seeks stockholders ratification of the 2015 Plan so that certain grants made to Covered Employees under the 2015 Plan, including stock options, stock appreciation rights and restricted stock awards and restricted stock units subject to performance-based vesting, will continue to qualify as “performance-based compensation” under Section 162(m) of the Code beyond the Reliance Period and therefore be exempt from the cap on the Company’s tax deduction imposed by Section 162(m) of the Code.

Our Board of Directors therefore believes that the ratification of the 2015 Plan is in the best interest ofachieving our stockholders given our current plans on hiring and the highly competitive environment in which we recruit and retain employees and consultants. If the stockholders do not ratify the 2015 Plan, the Company will either not make grants to Covered Employees under the 2015 Plan after the Reliance Period or will seek stockholder approval of a new stock plan before the end of the Reliance Period.

Summary of Material Features of the 2015 Plancompensation program goals.

The material features of the 2015 Plan are:

1,650,000 shares of common stock were initially reserved for issuance under the 2015 Plan and, pursuant to Section 3 of the Plan, the number of shares reserved and available for issuance will automatically increase each January 1, beginningvote on January 1, 2017, by 4% of the number of shares of our common stock issued and outstanding on the immediately preceding December 31 or such lesser number as determined by the Board or the compensation committee (the “Annual Increase”);

Shares of common stock that are forfeited, cancelled, held back upon the exercise or settlement of an award to cover the exercise price or tax withholding, reacquired by us prior to vesting, satisfied without the issuance of common stock or otherwise terminated (other than by exercise) under the 2015 Plan and our 2012 Equity Incentive (the “2012 Plan”) are added back to the shares of common stock available for issuance under the 2015 Plan;

Shares of common stock reacquired by the Company on the open market willthis resolution is not be added to the reserved pool under the 2015 Plan;

The award of stock options (both incentive and non-qualified options), stock appreciation rights, restricted stock awards, restricted stock units, unrestricted stock awards, cash-based awards, performance share awards and dividend equivalent rights is permitted;

No dividends or dividend equivalents may be paid on full value shares subject to performance vesting until such shares are actually earned upon satisfaction of the performance criteria;

Without stockholder approval, the exercise price of stock options and stock appreciation rights will not be reduced and stock options and stock appreciation rights will not be otherwise repriced through cancellation in exchange for cash, other awards or stock options or stock appreciation rights with a lower exercise price;

Any material amendment to the 2015 Plan is subject to approval by our stockholders; and

The term of the 2015 Plan will expire on October 16, 2025.

Based solely on the closing price of our common stock as reported by The NASDAQ Global Select Market on March 31, 2016, and the maximum number of shares that would have been available for awards as of such date, the maximum aggregate market value of the common stock that could potentially be issued under the 2015 Plan is $10,095,375.

Qualified Performance-Based Compensation under Section 162(m) of the Code

To ensure that certain awards granted under the 2015 Plan to Covered Employees qualify as “performance-based compensation” under Section 162(m) of the Code, the 2015 Plan provides that the compensation committee may require that the vesting of such awards be conditioned on the satisfaction of performance criteria that may include any or all of the following: (1) achievement of specified research and development, publication, clinical and/or regulatory milestones, (2) total shareholder return, (3) earnings before interest, taxes, depreciation and amortization, (4) net income (loss) (either before or after interest, taxes, depreciation and/or amortization), (5) changes in the market price of the common stock, (6) economic value-added, (7) funds from operations or similar measure, (8) sales or revenue, (9) acquisitions or strategic transactions, (10) operating income (loss), (11) cash flow (including, but not limited to, operating cash flow and free cash flow), (12) return on capital, assets, equity or investment, (13) return on sales, (14) gross or net profit levels, (15) productivity, (16) expense, (17) margins, (18) operating efficiency, (19) customer satisfaction, (20) working capital, (21) earnings (loss) per share of common stock, (22) sales or market shares and (23) number of customers, any of which may be measured either in absolute terms or as compared to any incremental increase or as compared to results of a peer group. The compensation committee will select the particular performance criteria within 90 days following the commencement of a performance cycle. Subject to adjustments for stock splits and similar events, the maximum award granted to any one individual that is intended to qualify as “performance-based compensation” under Section 162(m)address any specific element of compensation; rather, the Code will not exceed 1,750,000 shares of common stock for any performance cycle and options or stock appreciation rights with respect to no more than 1,750,000 shares of common stock may be granted to any one individual during any calendar year period. If a performance-based award is payable in cash, it cannot exceed $2,000,000 for any performance cycle.

The Board of Directors believes that it is important to maintain our flexibility to make awards to Covered Employees beyond the Reliance Period and to preserve our tax deduction for awards that qualify as “performance-based compensation” under Section 162(m) of the Code.

Summary of the 2015 Plan

The following description of certain features of the 2015 Plan is intended to be a summary only. The summary is qualified in its entirety by the full text of the 2015 Plan, which is attached hereto as Appendix A.

Plan Administration. The 2015 Plan is administered by the compensation committee. The compensation committee has full power to select, from among the individuals eligible for awards, the individuals to whomawards will be granted, to make any combination of awards to participants, and to determine the specific terms and conditions of each award, subject to the provisions of the 2015 Plan. The compensation committee may delegate to our chief executive officer the authority to grant awards to employees who are not subject to the reporting and other provisions of Section 16 of the Exchange Act and not subject to Section 162(m) of the Code, subject to certain limitations and guidelines.

Eligibility. Persons eligible to participate in the 2015 Plan are those full or part-time officers, employees, non-employee directors and other key persons (including consultants) of the Company and its subsidiaries as selected from time to time by the compensation committee at its discretion. As of March 31, 2016, approximately 69 individuals are currently eligible to participate in the 2015 Plan, which includes six (6) executive officers, 57 employees who are not officers, and six (6) non-employee directors (including a director who joined our Board of Directors in April 2016).

Plan Limits. The maximum award of stock options or stock appreciation rights granted to any one individual will not exceed 1,750,000 shares of common stock (subject to adjustment for stock splits and similar events) for any calendar year period. If any award of restricted stock, restricted stock units or performance shares granted to an individual is intended to qualify as “performance-based compensation” under Section 162(m) of the Code, then the maximum award shall not exceed 1,750,000 shares of common stock (subject to adjustment for stock splits and similar events) to any one such individual in any performance cycle. If any cash-based award is intended to qualify as “performance-based compensation” under Section 162(m) of the Code, then the maximum award to be paid in cash in any performance cycle may not exceed $2,000,000. In addition, no more than 1,650,000 shares of common stock may be issued in the form of incentive stock options, such number to be cumulatively increased on each January 1 by the lesser of the Annual Increase for such year or 3,300,000 shares of common stock.

Stock Options. The 2015 Plan permits the granting of (1) options to purchase common stock intended to qualify as incentive stock options under Section 422 of the Code and (2) options that do not so qualify. Options granted under the 2015 Plan will be non-qualified options if they fail to qualify as incentive options or exceed the annual limit on incentive stock options. Incentive stock options may only be granted to employees of the Company and its subsidiaries. Non-qualified options may be granted to any persons eligible to receive incentive options and to non-employee directors and key persons. The option exercise price of each option will be determined by the compensation committee but may not be less than 100% of the fair market value of the common stock on the date of grant. Fair market value for this purpose will be the last reported sale price of the shares of common stock on The NASDAQ Global Select Market on the date of grant. The exercise price of an option may not be reduced after the date of the option grant, other than to appropriately reflect changes in our capital structure.

The term of each option will be fixed by the compensation committee and may not exceed ten years from the date of grant. The compensation committee will determine at what time or times each option may be exercised. Options may be made exercisable in installments and the exercisability of options may be accelerated by the compensation committee. In general, unless otherwise permitted by the compensation committee, no option granted under the 2015 Plan is transferable by the optionee other than by will or by the laws of descent and distribution, and options may be exercised during the optionee’s lifetime only by the optionee, or by the optionee’s legal representative or guardian in the case of the optionee’s incapacity.

Upon exercise of options, the option exercise price must be paid in full either in cash, by certified or bank check or other instrument acceptablevote relates to the compensation committee or by delivery (or attestation to the ownership) of shares of common stock that are not then subject to any restrictions under any Company plan. Subject to applicable law, the exercise price may also be delivered to us by a broker pursuant to irrevocable instructions to the broker from the optionee. In addition,our named executive officers, as described in this proxy statement in accordance with the compensation committee may permit non-qualified options to be exercised using a net exercise feature, which reduces the number of shares issued to the optionee by the number of shares with a fair market value equal to the exercise price.

To qualify as incentive options, options must meet additional federal tax requirements, including a $100,000 limit on the value of shares subject to incentive options that first become exercisable by a participant in any one calendar year.

Stock Appreciation Rights. The compensation committee may award stock appreciation rights subject to such conditions and restrictions as the compensation committee may determine. Stock appreciation rights entitle

the recipient to shares of common stock equal to the value of the appreciation in the stock price over the exercise price. The exercise price may not be less than the fair market value of the common stock on the date of grant. The maximum term of a stock appreciation right is ten years.

Restricted Stock Awards. The compensation committee may award shares of common stock to participants subject to such conditions and restrictions as the compensation committee may determine. These conditions and restrictions may include the achievement of certain performance goals (as summarized above) and/or continued employment with us through a specified restricted period.

Restricted Stock Units. The compensation committee may award restricted stock units to any participants. Restricted stock units are ultimately payable in the form of shares of common stock and may be subject to such conditions and restrictions as the compensation committee may determine. These conditions and restrictions may include the achievement of certain performance goals (as summarized above) and/or continued employment with the Company through a specified vesting period or for board fees in lieu of cash compensation. In the compensation committee’s sole discretion, it may permit a participant to make an advance election to receive a portion of his or her future cash compensation otherwise due in the form of restricted stock units, subject to the participant’s compliance with the procedures established by the compensation committee and requirements of Section 409A of the Code. During the deferral period, the restricted stock units may be credited with dividend equivalent rights.

Unrestricted Stock Awards. The compensation committee may also grant shares of common stock that are free from any restrictions under the 2015 Plan. Unrestricted stock may be granted to any participant in recognition of past services or other valid consideration and may be issued in lieu of cash compensation due to such participant.

Cash-Based Awards. The compensation committee may grant cash bonuses under the 2015 Plan to participants. The cash bonuses may be subject to the achievement of certain performance goals (as summarized above).

Performance Share Awards. The compensation committee may grant performance share awards to any participant that entitle the recipient to receive shares of common stock upon the achievement of certain performance goals (as summarized above) and such other conditions as the compensation committee shall determine.

Dividend Equivalent Rights. The compensation committee may grant dividend equivalent rights to participants, which entitle the recipient to receive credits for dividends that would be paid if the recipient had held specified shares of common stock. Dividend equivalent rights may be granted as a component of another award (other than a stock option or stock appreciation right) or as a freestanding award. Dividend equivalent rights may be settled in cash, shares of common stock or a combination thereof, in a single installment or installments, as specified in the award.

Sale Event Provisions. The 2015 Plan provides that upon the effectiveness of a “sale event,” as defined in the 2015 Plan, the 2015 Plan and all awards thereunder will terminate, unless the parties to the sale event agree that such awards will be assumed or continued by the successor entity. In the event of such termination, (i) we may make or provide for a cash payment to participants holding options and stock appreciation rights, in exchange for the cancellation thereof, equal to the difference between the per share cash consideration in the saleevent and the exercise price of the options or stock appreciation rights, (ii) each participant shall be permitted, within a specified period of time prior to the consummation of the sale event, as determined by the compensation committee, to exercise all outstanding options and stock appreciation rights (to the extent then exercisable) held by such participant, or (iii) we may fully vest all outstanding awards. Notwithstanding anything to the contrary in the 2015 Plan, in the event of a sale event, all options and stock appreciation rights shall accelerate and become exercisable in full, all other awards with time-based vesting conditions or restrictions shall become fully vestedand nonforfeitable, and all awards with conditions and restrictions relating to the attainment of performance goals may become vested and nonforfeitable in the Committee’s discretion.

Adjustments for Stock Dividends, Stock Splits, Etc. The 2015 Plan requires the compensation committee to make appropriate adjustments to the number of shares of common stock that are subject to the 2015 Plan, to certain limits in the 2015 Plan, and to any outstanding awards to reflect stock dividends, stock splits, extraordinary cash dividends and similar events.

Tax Withholding. Participants in the 2015 Plan are responsible for the payment of any federal, state or local taxes that we are required by law to withhold upon the exercise of options or stock appreciation rights or vesting of other awards. Subject to approval by the compensation committee, participants may elect to have the minimum tax withholding obligations satisfied by authorizing the Company to withhold shares of common stock to be issued pursuant to exercise or vesting.

Amendments and Termination. The Board of Directors may at any time amend or discontinue the 2015 Plan and the compensation committee may at any time amend or cancel any outstanding award for the purpose of satisfying changes in the law or for any other lawful purpose. However, no such action may adversely affect any rights under any outstanding award without the holder’s consent. To the extent required under thedisclosure rules of the NASDAQ Stock Market, any amendments that materially change the terms of the 2015 Plan will be subject to approval by our stockholders. Amendments shall also be subject to approval bySEC.

Accordingly, we are asking our stockholders if andto vote on the following resolution at the Annual Meeting:

RESOLVED, that the stockholders hereby approve, on a non-binding advisory basis, the compensation paid to the extent determined by the compensation committee to be required by the Code to preserve the qualified status of incentive options or to ensure that compensation earned under the 2015 Plan qualifies as performance-based compensation under Section 162(m) of the Code.

Effective Date of 2015 Plan. The Board of Directors initially adopted the 2015 Plan on October 17, 2015 and it was approved by our stockholders on October 17, 2015 and became effective immediately prior to the consummation of our initial public offering. Awards of incentive options may be granted under the 2015 Plan until October 16, 2025. No other awards may be granted under the 2015 Plan after the date that is ten years from the date of stockholder approval.

Plan Benefits

Because the grant of awards under the 2015 Plan is within the discretion of the compensation committee, we cannot determine the dollar value or number of shares of common stock that will in the future be received by or allocated to any participant in the 2015 Plan. Accordingly, in lieu of providing information regarding benefits that will be received under the 2015 Plan, the following table provides information concerning the benefits that were received by the following persons and groups during calendar year 2015: eachCompany's named executive officer; all current executive officers, as a group; all current directors who are not executive officers, as a group; and all employees who are not executive officers, as a group.

| | | | | | | | |

| | | Options | |

Name and Position | | Average

Exercise Price

($) | | | Number (#) | |

Tassos Gianakakos President and Chief Executive Officer | | $ | 1.51 | | | | 431,290 | |

Jonathan C. Fox, M.D., Ph.D. Chief Medical Officer | | $ | 1.51 | | | | 19,047 | |

Jake Bauer Vice President, Business Development and Business Operations | | $ | 1.51 | | | | 36,734 | |

Steven Chan Vice President, Corporate Controller | | $ | 1.51 | | | | 20,407 | |

Joseph Lambing, Ph.D. Senior Vice President, Nonclinical and Pharmaceutical Development | | $ | 1.51 | | | | 57,142 | |

Robert S. McDowell, Ph.D. Senior Vice President of Drug Discovery | | $ | 1.51 | | | | 50,339 | |

All current executive officers, as a group | | $ | 1.51 | | | | 614,959 | |

All current directors who are not executive officers, as a group | | $ | 6.03 | | | | 65,337 | |

All current employees who are not executive officers, as a group | | $ | 4.11 | | | | 444,109 | |

Tax Aspects underdisclosed in the Code

The following is a summaryCompany's proxy statement for the 2020 Annual Meeting of the principal federal income tax consequences of certain transactions under the 2015 Plan. It does not describe all federal tax consequences under the 2015 Plan, nor does it describe state or local tax consequences.

Incentive Options. No taxable income is generally realized by the optionee upon the grant or exercise of an incentive option. If shares of common stock issued to an optioneeStockholders, pursuant to the exercise of an incentive option are sold or transferred after two years from the date of grant and after one year from the date of exercise, then (i) upon sale of such shares, any amount realized in excesscompensation disclosure rules of the option price (the amount paid forSEC, including the shares) will be taxed to the optionee as a long-term capital gain, and any loss sustained will be a long-term capital loss, and (ii) the Company will not be entitled to any deduction for federal income tax purposes. The exercise of an incentive option will give rise to an item of tax preference that may result in alternative minimum tax liability for the optionee.

If shares of common stock acquired upon the exercise of an incentive option are disposed of prior to the expiration of the two-year and one-year holding periods described above (a “disqualifying disposition”), generally (i) the optionee will realize ordinary income in the year of disposition in an amount equal to the excess (if any) of the fair market value of the shares of common stock at exercise (or, if less, the amount realized on a sale of such shares of common stock) over the exercise price thereof and (ii) the Company will be entitled to deduct such amount. Special rules apply where all or a portion of the exercise price of the incentive option is paid by tendering shares of common stock.

If an incentive option is exercised at a time when it no longer qualifies for the tax treatment described above, the option is treated as a non-qualified option. Generally, an incentive option will not be eligible for the

tax treatment described above if it is exercised more than three months following termination of employment (or one year in the case of termination of employment by reason of disability). In the case of termination of employment by reason of death, the three-month rule does not apply.

Non-Qualified Options. No income is realized by the optionee at the time the option is granted. Generally, (i) at exercise, ordinary income is realized by the optionee in an amount equal to the difference between the option pricecompensation tables and the fair market value ofnarrative discussions that accompany the shares of common stock on the date of exercise, and the Company receives a tax deduction for the same amount and (ii) at disposition, appreciation or depreciation after the date ofexercise is treated as either short-term or long-term capital gain or loss depending on how long the shares of common stock have been held. Special rules apply where all or a portion of the exercise price of the non-qualified option is paid by tendering shares of common stock. Upon exercise, the optionee will also be subject to Social Security taxes on the excess of the fair market value over the exercise price of the option.

Other Awards. The Company generally will be entitled to a tax deduction in connection with an award under the 2014 Plan in an amount equal to the ordinary income realized by the participant at the time the participant recognizes such income. Participants typically are subject to income tax and recognize such tax at the time that an award is exercised, vests or becomes non-forfeitable, unless the award provides for a further deferral.

Parachute Payments. The vesting of any portion of an option or other award that is accelerated due to the occurrence of a change in control (such as a sale event) may cause a portion of the payments with respect to such accelerated awards to be treated as “parachute payments,” as defined in the Code. Any such parachute payments may be non-deductible to the Company, in whole or in part, and may subject the recipient to a non-deductible 20% federal excise tax on all or a portion of such payment (in addition to other taxes ordinarily payable).

Limitation on Deductions. Under Section 162(m) of the Code, the Company’s deduction for certain awards under the 2015 Plan may be limited to the extent that the chief executive officer or other executive officer whose compensation is required to be reported in the summary compensation table (other than the principal financial officer) receives compensation in excess of $1 million a year (other than performance-based compensation that otherwise meets the requirements of Section 162(m) of the Code). The 2015 Plan is structured to allow certain awards to qualify as performance-based compensation.tables.

Equity Compensation Plans

The following table sets forth information as of December 31, 2015 regarding shares of common stock that may be issued under our equity compensation plans, consisting of the 2012 Plan, the 2015 Plan and our 2015 Employee Stock Purchase Plan (the “ESPP”).

| | | | | | | | | | | | |

| | | Equity Compensation Plan Information | |

Plan Category | | Number of Securities

to be Issued upon

Exercise of

Outstanding

Options, Warrants

and Rights

(a) | | | Weighted Average

Exercise Price of

Outstanding

Options,

Warrants and

Rights

(b) (1) | | | Number of Securities

Remaining Available

for Future Issuance

under Equity

Compensation Plans

(Excluding

Securities Reflected

in Column (a))

(c) | |

Equity compensation plans approved by security holders (2): | | | 1,318,647 | (3) | | $ | 2.29 | (3) | | | 1,752,071 | (4) |

Equity compensation plans not approved by security holders: | | | — | | | | — | | | | — | |

Total | | | 1,318,647 | | | | | | | | 1,752,071 | |

(1) | The weighted average exercise price is calculated based solely on outstanding stock options. |

(2) | The number of shares of common stock available for issuance under the 2015 Plan will be automatically increased each January 1, beginning with January 1, 2017, by the lesser of (i) 4% of the number of outstanding shares of the Company’s common stock on the immediately preceding December 31, and (ii) an amount as determined by the compensation committee of the Company’s Board of Directors. The number of shares of stock available for issuance under the ESPP will be automatically increased each January 1, beginning with January 1, 2017 and ending on January 1, 2025, by the lesser of: (i) 3,000,000 shares of common stock, (ii) 1% of the number of outstanding shares of common stock on the immediately preceding December 31 or (iii) such lesser amount of shares as determined by the compensation committee of the Company’s Board of Directors. These increases are not reflected in the table above. |

(3) | Does not include purchase rights accruing under the ESPP because the purchase right (and therefore the number of shares to be purchased) will not be determined until the end of the purchase period. |

(4) | Includes 1,497,071 shares of common stock remaining available for issuance under the 2015 Plan and 255,000 shares of common stock remaining available for issuance under the ESPP as of December 31, 2015. |

Required Vote

The ratificationapproval of the 2015 Stock Option and Incentive Planthis advisory non-binding proposal requires the affirmative vote of a majority of the votes cast on the proposal at the Annual Meeting (meaning the number of shares voted “for” the proposal must exceed the number of shares voted “against” the proposal).thereon. Abstentions and broker non-votes are not considered votes cast for the foregoing purpose, and will have no effect on this proposal.

The vote is advisory, which means that the vote foris not binding on the Company, our Board of Directors or our Compensation Committee. To the extent there is any significant vote against our named executive officer compensation as disclosed in this proposal.proxy statement, our Compensation Committee will evaluate whether any actions are necessary to address the concerns of stockholders.

Recommendation of the Board of Directors

The Board of Directors recommends that the stockholders vote FOR the ratificationapproval, on a non-binding advisory basis, of the 2015 Stock Option and Incentive Plan.compensation of the Company’s named executive officers, as disclosed in this proxy statement.

EXECUTIVE OFFICERS

The names of the executive officers of the Company, their ages as of March 31, 2016,2020, and certain other information about them are set forth below (unless set forth elsewhere in this Proxy Statement).

| | | | | | |

Name | | Age | | | Position |

Tassos Gianakakos | | 47 | 43 | | | President, Chief Executive Officer and Director |

Jonathan C. Fox, M.D., Ph.D.

| | | 59 | | | Chief Medical Officer |

Jake Bauer | | 41 | 37 | | | Vice President,Chief Business Development and Business OperationsOfficer |

Steven ChanWilliam Fairey

| | 55 | 44 | | | Executive Vice President, Corporate ControllerPresident; Chief Commercial Officer |

Joseph Lambing, Ph.D.Taylor C. Harris

| | 44 | 53 | Chief Financial Officer |

Cynthia J. Ladd | | Senior Vice President, Nonclinical and Pharmaceutical Development64 | | General Counsel |

Robert S. McDowell, Ph.D. | | 62 | 58 | | | Senior Vice President of Drug DiscoveryChief Scientific Officer |

Executive Officers

The biographies of our executive officers, other than Mr. Gianakakos, whose biography is set forth above, appear below.

Jonathan C. Fox, M.D., Ph.DJake Bauer. Dr. Fox Mr. Bauer has served as our Chief MedicalBusiness Officer since March 2013. PriorApril 2018, as our Senior Vice President, Finance and Corporate Development from July 2016 to joining us, he served as vice president of clinical development at AstraZeneca plc, a global biopharmaceutical company, from November 2006April 2018, and prior to July 2012 and before that served as an executive director at AstraZeneca from January 2004 to November 2006, with responsibility for the cardiovascular, metabolic and gastrointestinal products portfolio. Prior to AstraZeneca, he served as senior director, clinical cardiovascular research at Merck & Co. and director of clinical pharmacology at GlaxoSmithKline plc., a pharmaceutical company. Dr. Fox was a clinical professor of medicine at the University of Pennsylvania School of Medicine for two decades, and previously supervised a basic research laboratory focused on vascular biology. He serves as a consulting professor at Stanford University’s Cardiovascular Institute, as a consultant on Innovation, Technology and Alliances at the University of California, San Francisco, and is a longstanding Trustee of the Lankenau Institute for Medical Research in Wynnewood, PA. Dr. Fox also served a four-year term as the Industry Representative to the U.S. Food and Drug Administration’s Cardiovascular and Renal Drug Products Advisory Committee. Dr. Fox holds B.A., Ph.D. and M.D. degrees from the University of Chicago, and completed postgraduate training in internal medicine and cardiology at Duke University. We have entered into a Transition Services Agreement with Dr. Fox, pursuant to which Dr. Fox’s employment with the Company will end on September 30, 2016 and Dr. Fox will transition to a consultant position. For more information on the Transition Services Agreement, see “Compensation of Executive Officers—Transition Services Agreement with Jonathan Fox, M.D., Ph.D.”

Jake Bauer. Mr. Bauer has served as our Vice President, Business Development and Business Operations since July 2014. Prior to joining us, he was vice president, business operations and head of corporate development at Ablexis, LLC (“Ablexis”), a biotechnology company, from May 2011 to July 2014. At Ablexis, he led the development and implementation of the company’s corporate strategy and business development activities and oversaw business operations. Prior to Ablexis, Mr. Bauer was a principal at Third Rock Ventures, where he identified, evaluated and developed new opportunities for investment, assisted with startup, corporate development and operations of portfolio companies, and negotiated financings from 2007 to 2011. While at Third Rock Ventures, he was actively involved in a variety of leading biopharmaceutical companies including Agios Pharmaceuticals, Inc., CytomX Therapeutics Inc., Global Blood Therapeutics, Inc. and Zafgen, Inc., all biopharmaceutical companies. Prior to Third Rock Ventures, Mr. Bauer served in roles in the investment group at Royalty Pharma AG and the business development group at Endo Pharmaceuticals Inc., and was previously a management consultant at Putnam Associates. Mr. Bauer holds a B.Sc. in biology and a B.A. in economics from Duke University and an M.B.A. from Harvard Business School. He currently serves on the Board of Directors of Phoenix Tissue Repair, Inc.

Steven ChanWilliam Fairey. Mr. ChanFairey has served as our Executive Vice President, Corporate ControllerChief Commercial Officer since November 2014.January 2019. Prior to joining us and from March 2018 to January 2019, he held senior management positions at Solta Medical,served as executive vice president and chief commercial officer of ChemoCentryx, Inc., a global medical devicebiopharmaceutical company

where focused on discovering, developing and commercializing orally-administered therapeutics to treat autoimmune diseases, inflammatory disorders and cancer. During that time, he was responsible for the sales, marketing, medical affairs and market access functions, including commercialization of late stages compounds. Prior to ChemoCentryx, Mr. Fairey served in various roles at Actelion Pharmaceuticals Ltd. and its subsidiaries including president of Actelion Pharmaceuticals US, Inc., a pharmaceuticals and biotechnology company that specializes in orphan diseases, from April 2013 to December 2017, regional vice president, and corporate controller, responsible for leading day-to-day company-wide accounting and finance operationsAustralia Asia Pacific, of Actelion Pharmaceuticals Ltd. from June 2010July 2008 to July 2014. Prior to Solta Medical, Mr. Chan was viceMarch 2013, president finance at Moody’s Analyticsof Actelion Pharmaceuticals Canada Inc. from June 20072003 to June 2010, worldwide revenue director at Polycom2008, and vice president of sales and managed markets of Actelion Pharmaceuticals US, Inc. from October 2006January 2001 to June 2007, and a regional controller at Logitech International S.A. from August 2002 to October 2006. He started his career at KPMG LLP and has experience managing the accounting and finance functions at companies in varying stages of growth.2003. Mr. Chan is a certified public accountant in California (inactive status) andFairey holds a B.S. in business administrationbiology from the Haas School of Business at the University of California, Berkeley.Oregon and an M.B.A. from Saint Mary’s College of California.

Joseph Lambing, Ph.D. Dr. LambingTaylor C. Harris. Mr. Harris has served as our Senior Vice President, Nonclinical and Pharmaceutical DevelopmentChief Financial Officer since March 2014.April 2018. Prior to joining us and from April 2016 to April 2017, he served as senior vice president and chief financial officer of Zeltiq Aesthetics, Inc., a public company that markets the CoolSculpting cryolipolysis system. During that time, he was responsible for the global finance, accounting, tax, treasury, investor relations, and information technology functions, as well as the company’s commercial operations, including customer service, product support, and inside sales. Zeltiq was acquired by Allergan plc in April 2017. Prior to Zeltiq, Mr. Harris served as vice president and chief financial officer at Thoratec Corporation, a public company that develops, manufactures, and markets proprietary medical devices used for mechanical circulatory support for the treatment of heart failure patients worldwide, from October 2012 until October 2015, when the company was acquired by St. Jude Medical, Inc. Mr. Harris joined Thoratec as

its senior director of investor relations and business development in February 2010, in which capacity he was responsible for developing and executing the company's investor relations strategy, as well as supporting the company's strategic and business development activities. Prior to joining Thoratec, Mr. Harris worked at JPMorgan Chase & Co. for over a decade in several capacities, including as a vice president in the firm's Healthcare Investment Banking and Equity Research departments. Mr. Harris holds a B.A. in physics and economics from the University of North Carolina at Chapel Hill.

Cynthia J. Ladd. Ms. Ladd has served as our General Counsel since January 2018. Prior to joining us and since June 2015, she was senior vice president and general counsel of development for Portola Pharmaceuticals, Inc., aCytomX Therapeutics, an oncology-focused biopharmaceutical company, where he oversaw all preclinical and pharmaceutical development activities since the company’s founding from September 2003 to January 2013.company. Prior to Portola Pharmaceuticals, Dr. Lambing served as director of drug safety and disposition for Millennium Pharmaceuticals, Inc.’s, a biopharmaceutical company, San Francisco siteCytomX, Ms. Ladd was an independent consultant to biotechnology companies from February 20022006 to November 2003,June 2015, advising on corporate strategy, negotiations around collaborations, and clinical and regulatory issues, as a scientistwell as acting as general counsel. Prior to that, she was president and then directorchief executive officer of DMPK and toxicology at CORAGY Therapeutics Inc. from November 1994May 2003 to February 2002. During hisJune 2005, where she guided the company through a venture round and its transition to a clinical organization. Ms. Ladd previously served as senior vice president and general counsel at Pharmacyclics. Earlier in her career, Dr. Lambing has contributed to numerous NDAMs. Ladd held a number of positions at Genentech, Inc., including vice president of corporate law and IND filings for more than a dozen new chemical entities,chief corporate counsel. She began her career as well as numerous filings to support a variety of clinical trials in other countries. Dr. Lambingan associate with Wilson Sonsini Goodrich & Rosati, P.C., and Ware & Freidenrich LLP (now DLA Piper LLP (US)). Ms. Ladd holds a B.S. in chemistryanimal science from Penn State University, an M.S. in animal nutrition and biochemistry from Cornell University, and a Ph.D. in biochemistryJ.D. from the University of Missouri, and was a postdoctoral fellow at the University of California, San Diego.Stanford Law School.

Robert S. McDowell, Ph.D. Dr. McDowell has served as our Chief Scientific Officer since October 2017, and prior to that as our Senior Vice President of Drug Discovery since July 2012. Prior to joining us, Dr. McDowell led drug discovery at 3-V Biosciences, Inc. from October 2008 to July 2012, advancing the company’s lead program into development. Prior to 3-V Biosciences, he served as vice president of research at Sunesis Pharmaceuticals, Inc., a biopharmaceutical company, from January 2000 to 2008, where he oversaw drug discovery, translational research and manufacturing functions. Prior to Sunesis Pharmaceuticals, Dr. McDowell led the structural chemistry group at Axys Pharmaceuticals, Inc. Before joining Axys, Dr. McDowell was a senior scientist at Genentech Inc., where he developed successful strategies for peptidomimetic design. Dr. McDowell has authored more than 40 peer-reviewed manuscripts and is an inventor on more than 20 issued U.S. patents. Dr. McDowell holds a B.S. in chemistry and physics from Butler University and a Ph.D. in chemistry from the University of California, Berkeley.

COMPENSATION DISCUSSION AND ANALYSIS

Introduction

This Compensation Discussion and Analysis provides information regarding the 2019 compensation program for (i) each individual who served as our principal executive officer during the fiscal year ended December 31, 2019, (ii) each individual who served as our principal financial officer during the fiscal year ended December 31, 2019, (iii) the three most highly-compensated executive officers (other than the principal executive officer and principal financial officer) who were serving as executive officers on December 31, 2019 and (iv) an individual who would have been included under (iii) but for the fact that such individual was not serving as an executive officer on December 31, 2019 (such individuals collectively referred to as our “Named Executive Officers”). For 2019, our Named Executive Officers were:

| ▪ | Tassos Gianakakos, our President and Chief Executive Officer (our “CEO”); |

| ▪ | Taylor C. Harris, our Chief Financial Officer; |

| ▪ | William C. Fairey, our Executive Vice President, Chief Commercial Officer; |

| ▪ | Jake Bauer, our Chief Business Officer; |

| ▪ | Robert S. McDowell, PhD., our Chief Scientific Officer; and |

| ▪ | June Lee, M.D., our Executive Vice President, Chief Development Officer. |

This Compensation Discussion and Analysis describes the material elements of our executive compensation program during 2019. It also provides an overview of our executive compensation philosophy, including our principal compensation policies and practices. Finally, it analyzes how and why the Compensation Committee of our Board of Directors (the “Compensation Committee”) arrived at the specific compensation decisions for our Named Executive Officers in 2019 and discusses the key factors that the Compensation Committee considered in determining their compensation.

Management Changes

Mr. Fairey was appointed our Executive Vice President, Chief Commercial Officer in January 2019.

On September 30, 2019, it was agreed that Dr. Lee, Executive Vice President, Chief Development Officer, would be ending her employment with the Company following a transition period, which commenced on September 30, 2019 and will end on a date no later than June 30, 2020. During the transition period, Dr. Lee has retained her current title; however, effective September 30, 2019, Dr. Lee ceased to be an executive officer of the Company.

Executive Summary

Who We Are

We are a clinical-stage biopharmaceutical company pioneering a precision medicine approach to discover, develop and commercialize targeted therapies for the treatment of serious cardiovascular diseases. Precision medicine involves discovering and developing therapies that target the biological basis of disease for patient populations whose condition is defined by shared underlying defects and/or disease characteristics. By targeting the biomechanical defects underlying a given condition, we believe our therapeutic candidates can correct or offset the downstream disruption in cardiac muscle function that drives disease progression.

2019 Business Highlights

We made significant progress on several program and corporate milestones during 2019, including the following:

Mavacamten for HCM

Completed enrollment in EXPLORER-HCM. Enrollment of 251 patients was completed in August 2019 in the pivotal EXPLORER-HCM Phase 3 clinical trial. The EXPLORER-HCM study is designed to assess the effect of mavacamten in treating patients with symptomatic, obstructive hypertrophic cardiomyopathy (“HCM”). We now anticipate reporting topline data from the EXPLORER-HCM trial in the second quarter of 2020.

Presented 48-week data from PIONEER-OLE study of mavacamten. At the American Heart Association Scientific Sessions 2019, 48-week data from the PIONEER open-label extension (“OLE”) study of 12 patients with obstructive HCM were presented. Mavacamten was generally well-tolerated, and patients experienced sustained clinical benefit, including reductions in left ventricular outflow tract (“LVOT”) gradient, improvements in New York Heart Association (“NYHA”) functional class and improvement of multiple biomarkers toward normal ranges. These data were consistent with results reported at 12, 24 and 36 weeks.

Reported positive topline data from Phase 2 MAVERICK-HCM study. In the 16-week dose-ranging MAVERICK-HCM Phase 2 study, mavacamten was generally well-tolerated in patients with non-obstructive HCM. Statistically significant reductions in NT-proBNP, a marker of cardiac wall stress, were observed in patients across both mavacamten drug concentration cohorts. Clear signals of clinical benefit were also seen in subgroups of patients with elevated cardiac filling pressure at baseline and those at higher risk for morbidity and mortality.

Danicamtiv (MYK-491) for DCM

Announced positive interim data from the Phase 2a clinical trial of danicamtiv (formerly MYK-491). In an interim analysis of 26 patients with stable heart failure in the Phase 2a clinical multiple-ascending dose study, danicamtiv showed an improvement in systolic contractility, without impacting diastolic function. These results are consistent with data from our Phase 1 single-ascending dose studies of danicamtiv in both healthy volunteers and DCM patients. Based on the clinical and preclinical data generated to date, we plan to advance danicamtiv into a Phase 2 study in patients with genetic dilated cardiomyopathy. Results from the Phase 2a study, including additional cohorts, are anticipated in the second quarter of 2020.

MYK-224

Commenced dosing healthy volunteers in a Phase 1 study of MYK-224. We initiated a randomized, placebo-controlled Phase 1 study to assess the safety, tolerability and pharmacokinetics of MYK-224. In preclinical studies, MYK-224 was shown to attenuate hyperactive myosin proteins containing known pathogenic HCM mutations and modulated cardiac myosin without affecting myosin-actin cross-bridge kinetics or altering calcium homeostasis.

Corporate

Completed $270M financing. We completed a follow-on offering of 5,663,750 shares of common stock, including the full exercise of the underwriters’ over-allotment option, at a public offering price of $51.00 per share, raising approximately $271.2 million in net proceeds. We anticipate using net proceeds from the offering to support the ongoing registration studies, regulatory approval process, and commercial preparations for mavacamten for the potential treatment of obstructive HCM and to fund ongoing research and development efforts, as well as general corporate purposes.

Regained rights to HCM programs and danicamtiv (MYK-491) from Sanofi: We regained global commercial rights to all programs in its portfolio when the company’s collaboration with Sanofi ended at the beginning of 2019. In July, we reacquired U.S. royalty rights to mavacamten and MYK-224 from Sanofi for $80 million.

Executive Compensation Highlights

Based on our overall operating environment and achievements for the year, the Compensation Committee took the following key actions with respect to the compensation of our Named Executive Officers for and during 2019:

| ▪ | Base Salaries—Adjusted their annual base salaries by amounts ranging from zero percent to 13.2% for our Named Executive Officers other than our CEO, in addition to adjusting the annual base salary of our CEO by 7%. |

| ▪ | Annual Cash Incentive Bonuses—Based upon the levels of achievement of the corporate performance goals and individual performance goals established under our senior management cash incentive bonus plan for 2019, approved for our Named Executive Officers other than our CEO annual cash bonuses in amounts ranging from 102% to 107% of their target annual cash bonus opportunities, and an annual cash bonus for our CEO equal to 102% of his target annual cash bonus opportunity. |

| ▪ | Long-Term Incentive Compensation—Granted long-term incentive compensation opportunities in the form of options to purchase shares of our common stock and RSU awards that may vest and be settled for shares of our common stock with aggregate grant date fair values ranging from approximately $1,930,890 to approximately $2,549,933 for our Named Executive Officers (other than Mr. Fairey) other than our CEO, as well as an option to purchase shares of our common stock and an RSU award for our CEO with an aggregate grant date fair value of approximately $9,236,551. |

| ▪ | Compensation Arrangements with Mr. Fairey—In connection with his appointment as our Executive Vice President, Chief Commercial Officer, we entered into an employment offer letter dated January 5, 2019 (the “Employment Offer Letter”) with Mr. Fairey. Pursuant to the Employment Offer Letter, our initial compensation arrangements with Mr. Fairey were as follows: |

| ▪ | an initial annualized base salary of $500,000; |

| ▪ | a target annual cash incentive bonus opportunity equal to 45% of his annual base salary, based on his achievement relative to certain performance goals to be recommended by our CEO and approved by our Board of Directors; |

| ▪ | a sign-on bonus in the amount of $225,000, subject to reimbursement of the Company in the event that he should terminate his employment with us within 12 months of his hire date; |

| ▪ | an option to purchase 69,500 of shares of our common stock with an exercise price equal to the fair market value of our common stock on the date of grant, and with such option to vest (and become exercisable) over a four year period beginning with 25% of the shares of our common stock subject to the option vesting on the first anniversary of his employment start date and the remaining shares subject to the option vesting in equal monthly installments thereafter over the next 36 months, contingent upon him remaining continuously employed by us through each applicable vesting date; and |

| ▪ | an RSU award for 32,500 shares of our common stock, with such award to vest as to 25% of the shares of our common stock subject to the award on the first anniversary of his employment start date and the remaining shares subject to the award vesting in equal annual installments thereafter over the next three years, contingent upon him remaining continuously employed by us through each applicable vesting date. |

In addition, the Employment Offer Letter provides that Mr. Fairey is eligible to receive certain payments and benefits in the event that his employment is terminated without cause (as defined in the Employment Offer Letter) as described in more detail in “Potential Payments Upon Termination or Change in Control” below.

The Employment Offer Letter was negotiated on our behalf by our CEO and approved by the Compensation Committee. In establishing these initial compensation arrangements, we took into consideration the requisite experience and skills that a qualified candidate would need to work in a growing business in a dynamic and ever-changing environment, the competitive market for similar positions at other comparable companies based on a review of peer group compensation data, and the need to integrate Mr. Fairey into the executive compensation structure that we had developed since our initial public offering of our equity securities, balancing both competitive and internal equity considerations. For a summary of the material terms and conditions of the Employment Offer Letter, see “Potential Payments Upon Termination or Change in Control” below.

Pay-for-Performance

We believe our executive compensation program is reasonable and competitive, and appropriately balances the goals of attracting, motivating, rewarding, and retaining our executive officers with the goal of aligning their interests with those of our stockholders. To ensure this alignment and to motivate and reward individual initiative and effort, a significant portion of our executive officers’ annual target total direct compensation is both variable in nature and “at-risk.”

We emphasize variable compensation that appropriately rewards our executive officers, including our Named Executive Officers, through three separate compensation elements:

| ▪ | First, we provide the opportunity to participate in our senior management cash bonus planwhich provides cash payments if they produce short-term operational and strategic results that meet or exceed the objectives established by our Board of Directors at the beginning of the year. |

| ▪ | In addition, we grant options to purchase shares of our common stock, which comprise a significant portion of their target total direct compensation, the value of which depends entirely on appreciation in the value of our common stock, aligning their interests with those of our stockholders. |

| ▪ | Finally, we grant RSU awards, the value of which depends entirely on the value of our common stock, thereby incentivizing them to build sustainable long-term value for the benefit of our stockholders. |

These variable pay elements ensure that, each year, a significant portion of our executive officers’ target total direct compensation is contingent (rather than fixed) in nature, with the amounts ultimately payable subject to variability above or below target levels commensurate with our actual performance.

We believe that this design provides balanced incentives for our executive officers to drive financial and operational performance and, thereby, create long-term growth.

Executive Compensation Policies and Practices

We endeavor to maintain sound governance standards consistent with our executive compensation policies and practices. The Compensation Committee evaluates our executive compensation program on a regular basis to ensure that it is consistent with our short-term and long-term goals given the dynamic nature of our business and the market in which we compete for executive talent. During 2019, we maintained the following executive compensation policies and practices, including both policies and practices we have implemented to drive performance and policies and practices that either prohibit or minimize behavior that we do not believe serve our stockholders’ long-term interests:

What We Do

| ▪ | Pay for Performance. Total compensation for our executive officers is heavily weighted towards annual incentive compensation and equity awards, both of which encourage financial and operational performance to drive the creation of stockholder value. |

| ▪ | Maintain an Independent Compensation Committee. The Compensation Committee consists solely of independent directors who establish our compensation policies and practices. |

| ▪ | Retain an Independent Compensation Consultant. The Compensation Committee has engaged its own compensation consultant to provide information, analysis, and other advice on executive and director compensation independent of management. This compensation consultant performed no other consulting or other services for us in 2019. |

| ▪ | Annual Executive Compensation Review. The Compensation Committee conducts an annual review and approval of our compensation strategy, including a review and determination of our compensation peer group used for comparative purposes and a review of our compensation-related risk profile to ensure that our compensation programs do not encourage excessive or inappropriate risk-taking and that the level of risk that they do encourage is not reasonably likely to have a material adverse effect on us. |